As financial advisors, we know that your investment philosophy is one of the cornerstones of your practice. Your clients want to know that you follow a sound framework that they can rely on at every stage and that it is engineered to give them the best chance of achieving their financial goals. At the Wealth Advisor Alliance, we provide our advisors with outsourced investment models, communications and implementation that are grounded in time-tested principles for investment success.

Financial Plans Supported by an

Evidence-Based Investing Approach

Instead of attempting to time the market or react with emotion, our investment program is grounded in diligence, discipline and diversification. We have developed a consistent, strategic investment philosophy supported by both academic research and the latest in portfolio theory. We love and trust data. The data has led us to the mutual funds and ETFs offered by Dimensional Fund Advisors and Vanguard because they hold thousands of securities at very low cost, which is made possible by each company’s extensive global trading infrastructure.

Careful trading and implementation within Dimensional’s institutional funds has reduced and even reversed the costs borne by traditional managers and separately managed account (SMA) solutions, savings of which accrue directly to investor returns. As Dimensional notes, their investment philosophy has evolved since the firm began in 1981: “Dimensional Investing is about implementing the great ideas in finance for our clients.”

Rely on the Knowledge of Subject Matter Experts and Strategic Partners

As part of our approach, we employ aggregated portfolio management, tax-sensitive trading to bring down cost and maximize return potential and allocations that optimize for risk and return. The fixed income investments, which we collaborated with Dimensional to design and bring to market, complement the equities within clients’ portfolios and hedge inflation risk. Our top priority is to ensure that clients’ portfolios operate in a reliable way that reflects their future financial goals, tolerance for risk and time horizon. Ongoing, we work with advisors to continually adjust our trading in the real-world, so we remain well-positioned to meet their clients’ objectives and in their best interests.

With distinct educational backgrounds and experience as advisors to clients ourselves, the Wealth Advisor Alliance team has experience supporting advisor just like you in the areas of portfolio management, retirement planning, estate planning, insurance analysis and income tax planning.

About the Forum Investment Committee

We are fortunate to have access to diverse industry knowledge and expertise through Forum Financial Management, the Wealth Advisor Alliance’s parent company, to help guide our investment philosophy and approach.

3

CFAs

3

UofC MBAs

6

Partners

6

Traders

Three members have an MBA from the University of Chicago Booth School of Business and three members hold the Chartered Financial Analyst® Designation.

Insight From Our Investment Committee

A Premium Predicament

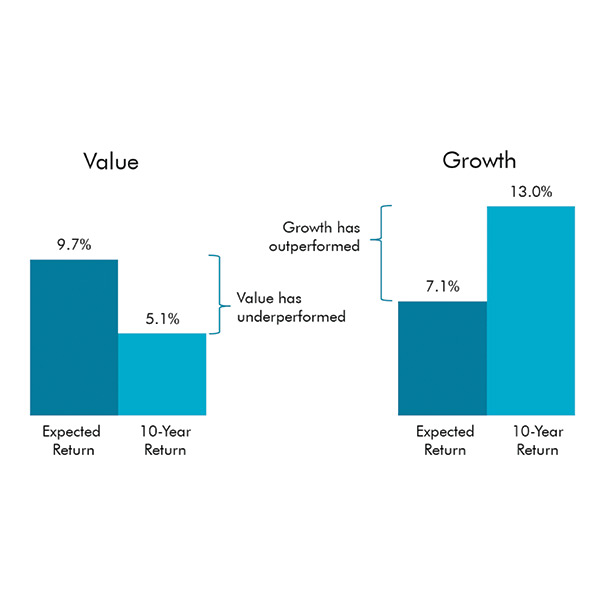

The merits of Value, Small Cap and Profitability as factors in a diversified equity portfolio have had a challenging time in recent years. Wealth Advisor Alliance Co-Managing Partner Jonathan Rogers provides a comprehensive review of the literature and data around the recent decade over which Value has been outperformed by Growth.